short term rental tax deductions

Maximize Your Short Term Rental Tax Deductions

Posted on Oct 30, 2025

Welcome to your guide for turning property expenses into serious tax savings. In this section, we'll break down exactly what short term rental tax deductions are and why they are absolutely essential for boosting your bottom line.

Think of it this way: every single dollar you spend to keep your rental running can potentially shrink your taxable income, which means a smaller tax bill at the end of the year.

Your Guide to Rental Property Tax Deductions

The moment you list your property on a platform like Airbnb or Vrbo, the IRS sees it differently. It's no longer just an asset; it's a business. This shift is incredibly powerful because it unlocks your ability to write off all the "ordinary and necessary" expenses that come with operating and maintaining your rental.

Understanding these deductions isn’t just about scrambling to find receipts in April. It’s a core part of a smart, year-round business strategy. When you start treating your rental like a business from day one, you can turn routine costs into powerful tax savings. It's this proactive mindset that separates the most successful hosts from those who unknowingly leave money on the table.

Why Tax Deductions Matter

The short-term rental world isn't a small-time side hustle anymore; it has grown into a massive economic force. The global market is projected to hit a staggering $134.26 billion by 2034. In a market this big, getting a handle on your tax deductions is fundamental to your profitability.

One of the biggest write-offs for most owners is mortgage interest and any related financing costs. This is especially true in the first few years of your mortgage when interest payments make up the largest chunk of your payment. This single deduction can offset a huge portion of your rental income.

This guide is your roadmap to all the opportunities available. It's designed to demystify the tax code and get you thinking like the savvy business owner you are. And beyond the common deductions, you may find specific relief programs that can help you maximize tax benefits for your property.

The Most Impactful Deduction Categories

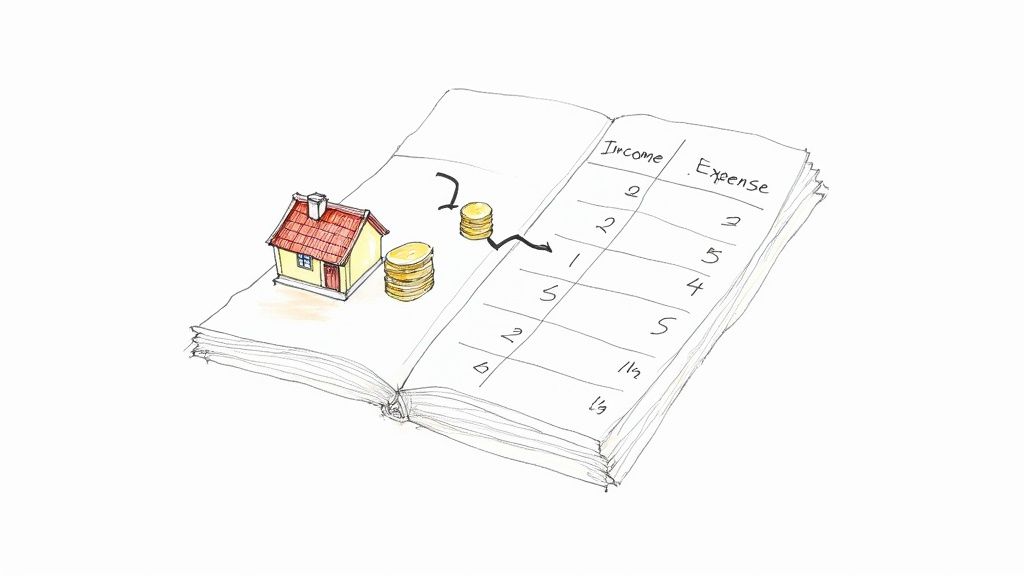

To get started, it’s helpful to zoom out and look at the big picture. Most of your expenses will fall into a few key categories that form the backbone of your tax strategy. Once you know these categories, tracking your spending throughout the year becomes so much easier.

Let's quickly go over the major types of expenses that are generally deductible for your short-term rental.

Top Short-Term Rental Tax Deduction Categories at a Glance

Here’s a quick summary of the most common and valuable tax deductions available to short-term rental owners. Think of these as the primary buckets you'll be filling with receipts and invoices all year long.

| Deduction Category | Description & Examples |

|---|---|

| Operating Expenses | These are the day-to-day costs of just keeping the lights on. Think cleaning fees between guests, property management fees, guest supplies (coffee, soap, toilet paper), and marketing costs. |

| Property-Related Costs | This bucket covers the big-ticket items tied directly to owning the property itself. The most common examples are mortgage interest, property taxes, and homeowners insurance. |

| Repairs & Maintenance | This is for the costs of keeping your property in good shape. We're talking about fixing a leaky faucet, patching a hole in the wall, or repairing a broken appliance. These are necessary fixes, not upgrades. |

| Depreciation | This is a game-changer. Depreciation is a non-cash deduction that lets you write off the cost of your property and major improvements over time. It’s one of the most powerful tax benefits available to real estate investors. |

Tracking these expenses meticulously is your best defense against a high tax bill. Every documented expense is a potential tool to lower your taxable income, which puts more money directly back into your pocket.

Of course, claiming these write-offs correctly requires diligent record-keeping—a skill we dive deeper into in our guide on managing vacation rental property. Getting this part right is what truly turns your rental from a hobby into a financially successful business.

How Your Property Use Impacts Deductions

Before we even talk about writing off a single welcome basket, we have to get one thing straight: how does the IRS actually see your property? This isn't just a small detail; it's the bedrock of your entire tax strategy. The big question is whether you're running a dedicated rental business or a hybrid property you also enjoy personally.

Picture two different hosts. Host A has a city condo that's rented out to guests all year round. Then there's Host B, who owns a beach house they list for the summer but use for their own family getaways in the spring and fall. These two owners are playing in completely different tax leagues, and the short term rental tax deductions they can claim will look worlds apart.

This distinction between rental and personal use is the starting line. Meticulous tracking isn't just a good idea—it’s non-negotiable. The ratio of rental days to personal days will dictate how you split up those big, shared expenses.

Demystifying the IRS 14-Day Rule

One of the first—and most critical—concepts for any host to wrap their head around is the "14-day rule." It's a simple threshold that can completely change your tax situation, especially if you mix personal stays with guest bookings.

Here’s the breakdown:

- Rent for 14 Days or Less: If you rent your place out for 14 days or fewer during the year and use it yourself for more than 14 days, you generally don't have to report any of that rental income. The flip side? You can't deduct any rental expenses. The IRS basically treats it as a tax-free hobby.

- Rent for More Than 14 Days: The moment you cross that 14-day line, your property is officially a rental business in the eyes of the IRS. You must report all the income you make, but this also unlocks the door to deducting your expenses.

A common myth is that days you spend on-site doing major repairs or maintenance count as "personal use" days. Good news: they don't. If you block off a weekend to fix the plumbing and repaint the guest room, those days won't dilute your rental-use percentage.

Prorating Expenses for Mixed-Use Properties

So, what happens if your property pulls double duty for both guests and personal use (for more than 14 days)? You've got to divide your expenses. You can't just write off the full annual cost of things like mortgage interest or property insurance. Instead, you have to allocate them based on how the property was used.

The math is pretty simple. Just divide the total number of days the property was rented to guests by the total number of days it was actually used (rental days + personal days). This gives you a rental-use percentage, which you then apply to your shared, or "indirect," expenses.

Let’s say you rented your property for 100 days and used it personally for 25 days. Your total usage is 125 days. That makes your rental-use percentage 80% (100 ÷ 125). You could then deduct 80% of your mortgage interest, property taxes, and insurance for that year. Easy.

Of course, any expenses that are 100% for the rental—like guest cleaning fees, booking platform commissions, or a new set of towels just for guests—are fully deductible.

Unlocking Advanced Tax Benefits

For hosts who are really serious about their rental business, there are a couple of powerful IRS classifications that can open up some significant tax advantages, letting you treat your rental more like a traditional business.

Two key concepts you need to know are:

- Material Participation: This is an IRS test to prove you're involved in your rental's operations on a "regular, continuous, and substantial" basis. There are a few ways to prove this, like working more than 500 hours a year on the rental or simply doing more work on it than anyone else (including your property manager).

- Real Estate Professional Status (REPS): This is a much higher bar to clear, typically reserved for people who spend the majority of their working hours in real estate trades.

Qualifying for these can be a total game-changer. If your average guest stay is seven days or less and you can prove you materially participate, the IRS might no longer see your property as a "passive activity." This is a huge deal. It can allow you to deduct rental losses against your regular income (like your W-2 job), potentially creating massive tax savings. Of course, getting there means maximizing your nightly rates and occupancy, a strategy we dive deep into in our guide to vacation rental revenue management.

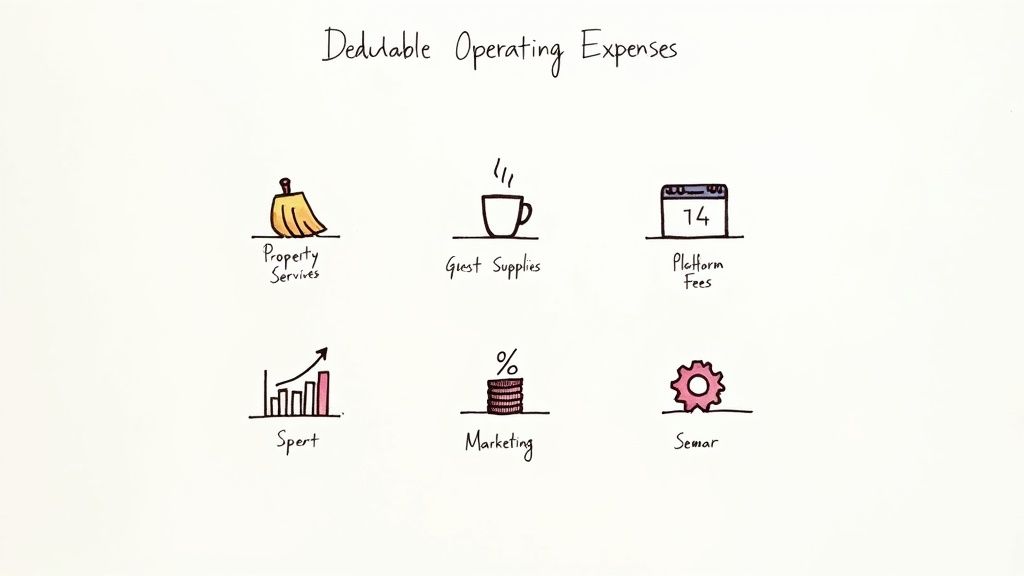

Uncovering Every Deductible Operating Expense

Once your property is officially a business in the eyes of the IRS, a whole new world of short term rental tax deductions opens up. These are what the IRS calls "ordinary and necessary" expenses—basically, everything you spend to keep your rental up and running day-to-day.

Think of your rental as an engine. These operating expenses are the fuel, oil, and regular tune-ups that keep it humming along and making you money.

Every single dollar you spend on these items can be a dollar you don't pay taxes on. This is where tracking every little thing really pays off, turning your routine costs into powerful tax-saving tools. Let's break down these everyday write-offs so you don't miss a thing.

Essential Property Services

These are the big ones—the costs for the professional services you need to maintain your property and keep guests happy. They're often the largest and most consistent expenses you'll have.

Cleaning and Management Fees: The money you pay your cleaning crew between guest stays? That's 100% deductible. The same goes for a property manager you hire to handle bookings and day-to-day operations. Their entire fee is a business expense.

Landscaping and Pool Care: Keeping up your property's curb appeal isn't just for show; it's a business necessity. The cost of mowing the lawn, tending the garden, and regular pool maintenance are all valid write-offs.

Pest Control and Security: Regular pest control services and the monthly fees for a security monitoring system are deductible. They're part of ensuring a safe and comfortable stay for your guests.

These services are the hands-on work that keeps your rental in prime condition. Every invoice from a contractor or property manager is a potential deduction you can't afford to miss.

Guest-Facing Supplies and Amenities

All those small touches that help you score a five-star review are also valuable tax write-offs. We're talking about the consumable items you stock to make each stay feel special and comfortable.

Don't underestimate these small deductions. A single bottle of shampoo might seem minor, but when you add up the cost of stocking your rental for dozens of guests over a year, it can easily turn into thousands of dollars in deductible expenses.

Common examples include:

- Consumables: Coffee, tea, sugar, spices, and bottled water.

- Toiletries: Soap, shampoo, conditioner, and toilet paper.

- Welcome Baskets: Snacks, local treats, or that bottle of wine you leave for arriving guests.

- Linens and Towels: While the initial purchase of high-end linens might be depreciated, the cost of replacing them due to normal wear and tear can often be deducted as a current operating expense.

Here’s a simple rule of thumb: if a guest uses it up or it needs to be replaced often, it's probably a deductible supply.

Core Business and Administrative Operations

Running a short-term rental is about more than just the property; you're running a business. All the administrative and marketing costs that come with it are fully deductible. These are the expenses that help you find guests and run your operation smoothly.

Here are some of the most important business-related short term rental tax deductions:

Platform Fees: Those service fees that platforms like Airbnb, Vrbo, and Booking.com charge are direct costs of doing business. They are absolutely deductible.

Marketing and Advertising: Did you hire a professional photographer for your listing? That’s a write-off. Any money you spent on social media ads, website hosting, or even printing flyers counts, too.

Software Subscriptions: The monthly or annual fees for your accounting software, dynamic pricing tools, or channel managers are all deductible. Investing in the right tech can save you a ton of time, and you can learn about the best property management software for vacation rentals to see how these tools can quickly pay for themselves.

Professional Fees: Did you pay a lawyer to draft a rental agreement or an accountant to help with your taxes? Those costs are deductible business expenses.

By sorting your spending into these categories, you create a simple framework for tracking every penny. This organized approach ensures you won't overlook valuable deductions, turning everyday costs into a smart strategy for lowering your taxable income.

Understanding Capital Expenses and Depreciation

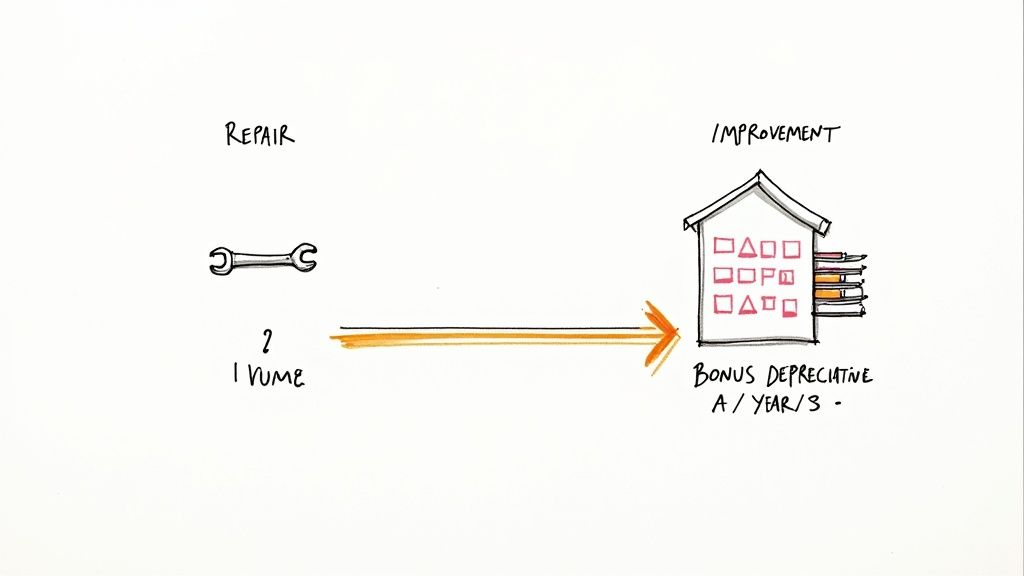

While deducting day-to-day operating costs is a great start, the really big short term rental tax deductions come from larger, less frequent investments. This is where you need to know the difference between a simple repair and a major improvement—it’s the key to unlocking some serious savings.

Think of it this way: if a single shingle blows off your roof and you replace it, that's a repair. You deduct the cost right away. But if you replace the entire roof, that’s a capital improvement. It's a major investment that adds real value and extends the life of your property. You can't just write off the whole cost in one year. Instead, you deduct it over time through a process called depreciation.

The Power of Depreciation

Depreciation is hands-down one of the best tax perks for real estate investors. It lets you deduct the cost of your property and its major improvements over a set period, even though you likely paid for it all at once. This creates a "paper loss" that can dramatically lower your taxable rental income without affecting your cash flow.

For a short-term rental, the IRS says the building itself is depreciated over 39 years. That might sound painfully slow, but it provides a reliable, steady deduction every single year. More importantly, it sets the stage for much faster write-offs.

Accelerating Your Deductions with Bonus Depreciation

Now for the exciting part. While the building has a long road ahead, many of the things inside it—furniture, appliances, new flooring—can be written off much, much faster. This is all thanks to a fantastic tax tool called bonus depreciation.

Instead of spreading out the deduction for a new living room set or a fancy refrigerator over several years, bonus depreciation often lets you deduct 100% of the cost in the very first year. This is a game-changer. It front-loads your tax savings and frees up a ton of cash you can put right back into growing your rental business.

And there's great news for U.S. property owners: recent legislation restored 100% bonus depreciation for qualifying assets from 2025 through 2029. Spend $15,000 on new furnishings and you can potentially deduct that entire amount from your income in the year you buy it. You can learn more about this valuable tax policy update to see how it might apply to your STR.

A Practical Example of Bonus Depreciation

Let's put this into real-world terms. Say you just bought a new STR and need to furnish it from scratch.

- Total Furnishing Cost: You spend $20,000 on furniture, appliances, TVs, and decor.

- Without Bonus Depreciation: You'd have to depreciate that cost over 5-7 years, getting just a small deduction each year.

- With 100% Bonus Depreciation: You can deduct the entire $20,000 from your rental income in the same year.

This single strategy can turn a profitable year into a tax loss on paper, potentially wiping out your tax bill on your rental income and keeping thousands of dollars in your pocket.

Pro-Level Strategy: Cost Segregation

Ready to take it to the next level? For hosts who want to squeeze every last drop out of their depreciation benefits, there's an advanced strategy called a cost segregation study.

This involves hiring a specialized engineering firm to analyze your property. They'll identify components of the building that can be legally reclassified into shorter depreciation categories.

Instead of seeing the property as one big 39-year asset, a cost segregation study might find that things like carpeting, specialty lighting, and landscaping can be depreciated over 5, 7, or 15 years. This allows you to accelerate a huge chunk of the building's cost, and when you combine that with bonus depreciation, you can create a massive first-year deduction. It’s an upfront investment, but the tax savings can be enormous, making it a favorite strategy of serious real estate investors.

Navigating Global and Local Tax Laws

Getting the most out of your short term rental tax deductions isn't just about meticulous expense tracking. You also have to navigate a complex web of laws that can change dramatically from one country, state, or even city to the next.

Think of your tax strategy like a finely tuned engine. Federal rules, like depreciation, are the powerful pistons doing the heavy lifting. But the local and international regulations? That's the specific type of fuel and oil your engine needs. Use the wrong kind, and the whole system can seize up.

This legal patchwork means a tax strategy that's brilliant in one location could be completely useless—or worse, illegal—somewhere else. A host in the U.S. might be able to leverage pro-business depreciation rules to generate big paper losses, while a host over in Europe could be facing a totally different set of compliance hurdles. Ignoring these differences is a recipe for disaster.

Global Variations in Rental Taxation

Tax policies for short-term rentals are anything but universal. Some governments are tightening their grip, while others are offering more favorable terms. This contrast really drives home why a one-size-fits-all approach to tax planning is a non-starter. The regulatory climate where your property sits is a massive factor in your bottom line.

While the U.S. is currently a friendly market for STR hosts, not every country is on the same page. Take France, for example. Their 2025 regulations are signaling a major crackdown, cutting tax breaks and capping rentals at 90 days per year for non-primary homes. This is part of a bigger European trend, where the EU now requires platforms to issue unique property IDs and share data with tax authorities, as you can see in these updated vacation rental statistics.

To really get ahead, it's worth exploring strategies for unlocking the secrets to tax efficiency and financial freedom, particularly when dealing with international tax agreements.

How Local Ordinances Can Reshape Your Strategy

The impact of local laws can be even more direct and, frankly, more profound. City Hall can dictate everything from who is allowed to host and for how long, to what specific safety gear your property needs. These rules can fundamentally reshape your business model and, by extension, your entire tax strategy.

A perfect, if painful, example is New York City, which rolled out some of the most restrictive short-term rental laws on the planet. The city's rules effectively outlawed most Airbnb-style rentals in multi-unit buildings for stays under 30 days unless the host is physically present.

This kind of local ordinance directly hits your ability to make money and, therefore, your ability to claim certain deductions. Here are a few ways city and county rules can throw a wrench in your tax plans:

- Limiting Rental Days: Ordinances that put a cap on how many nights you can rent each year will obviously limit your income. It also changes the math on how you prorate expenses between personal and rental use.

- Imposing Licensing Fees: Lots of cities now make hosts get a business license or permit. The good news? The cost of that license is a deductible operating expense.

- Mandating Property Upgrades: Local rules might require you to install specific safety features, like extra smoke detectors or new fire extinguishers. While these are capital improvements that you have to depreciate over time, they are still valuable write-offs.

At the end of the day, staying vigilant and informed is just as critical as keeping your receipts organized. The most successful hosts I know understand that compliance isn't just about dodging fines; it's about building a sustainable business on a solid legal and financial foundation. Make a habit of checking your local government's website and keeping up with regional news—it's an essential part of any smart tax and business strategy.

Got Questions? We've Got Answers.

When it comes to short term rental tax deductions, the devil is truly in the details. You can get the big picture right, but then a specific, real-world situation pops up and you're left scratching your head. This is where we clear the air on the most common questions we hear from hosts like you.

Think of this as your go-to guide for those nagging "what if" scenarios. We'll give you straight, practical answers to help you handle your rental taxes with total confidence.

Can I Deduct Travel Costs to My Rental Property?

Absolutely—as long as the trip's primary purpose is managing your rental. If you’re flying out to oversee a renovation, interview a new cleaning crew, or do a deep inventory check, those travel costs are on the table.

This can include things like:

- Your flight or mileage if you drive.

- Hotel or lodging costs for the work portion of your stay.

- A percentage of your meal expenses.

But here's the catch: you've got to be honest if the trip is a mix of work and play. Let's say you spend three days fixing a leaky roof and then two days lounging on the beach. You can only deduct the expenses for those three business days. Meticulous records are your best friend here. A daily log of what you did, paired with every single receipt, is non-negotiable if you want to justify the deduction to the IRS.

What Records Should I Keep for My Deductions?

Great question. Your records are the foundation of your entire tax strategy. They're your proof, your backup, and your best defense in the unlikely event of an audit. Your goal is to create an undeniable paper trail for every single dollar you claim.

At a bare minimum, you need to keep digital or physical copies of everything.

- Financial Proof: This means every receipt, invoice, and the bank or credit card statements that show the transaction cleared.

- Property Paperwork: Keep your mortgage interest statement (Form 1098), property tax bills, and insurance policies handy.

- Usage Logs: This is a big one. You need a calendar that tracks every single night the property was rented out versus every night you used it personally. This ratio is the key to correctly prorating all your shared expenses.

Let’s be real: a dedicated spreadsheet or accounting software isn't just a nice-to-have, it's a must for any serious host. Tracking expenses as they happen will save you from a frantic shoebox search come April and ensures your claims are rock-solid.

How Do I Handle Deductions with Personal Use?

When you use your rental for a personal getaway, you have to split most of your expenses between business and pleasure. You can only deduct the portion of an expense that directly relates to the time it was available for rent.

The math is actually pretty simple:

- Count Your Rental Days: Add up the total number of days the property was rented at a fair market rate.

- Count Your Total Use Days: Add your rental days and your personal use days together.

- Find Your Percentage: Divide the rental days by the total use days. That’s your rental-use percentage.

For example, your property was rented for 90 days and you stayed there for 10 days. The total usage is 100 days. Your rental-use percentage is 90% (90 divided by 100). That means you get to deduct 90% of your indirect costs—things like mortgage interest, property taxes, and utilities.

Direct expenses, on the other hand, like guest-specific cleaning fees or booking commissions, are always 100% deductible.

When Is It Time to Hire a Tax Professional?

Look, DIY tax software is great for simple returns. But running a short-term rental business is rarely simple. Hiring a Certified Public Accountant (CPA) who lives and breathes real estate isn't just an expense; it's a strategic investment that almost always pays for itself.

You should seriously consider calling in an expert if you:

- Own more than one rental property.

- Are curious about advanced strategies like cost segregation or bonus depreciation.

- Want to see if you can qualify for "Real Estate Professional Status" to unlock some major tax breaks.

A specialist won't just keep you compliant—they'll proactively hunt for deductions you didn't even know existed. The money they can save you often blows their fee out of the water, giving you both a healthier bottom line and priceless peace of mind.

Ready to turn those five-star reviews into more direct bookings and revenue? hostAI uses advanced AI to build you a powerful online presence, from automated email marketing with hostMail to intelligent website creation with hostFront. Stop letting platforms control your business and start building your brand. Discover how leading STR managers are doubling their direct revenue at https://gethostai.com.